- Home

-

Companies

-

Food & Beverage Brands

See All

Food & Beverage Brands

See All -

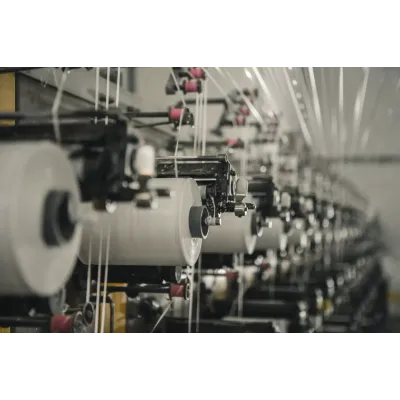

Textile & Apparel Industry Brands

See All

Textile & Apparel Industry Brands

See All -

Home Furniture Brands

See All

Home Furniture Brands

See All -

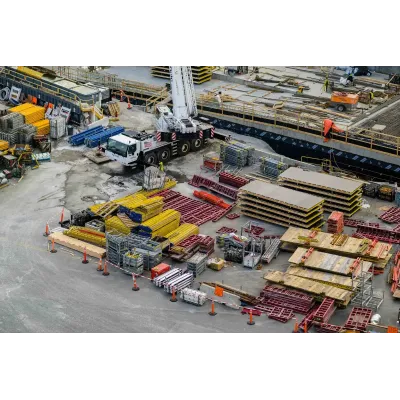

Building Materials Companies

See All

Building Materials Companies

See All -

Paper & Printing Brands

See All

Paper & Printing Brands

See All -

Energy & Chemical Companies

See All

Energy & Chemical Companies

See All -

Biopharmaceutical Companies

See All

Biopharmaceutical Companies

See All -

Mining & Minerals Companies

See All

Mining & Minerals Companies

See All -

Metal Smelting & Processing Companies

See All

Metal Smelting & Processing Companies

See All -

Metal Products Companies

See All

Metal Products Companies

See All -

Machinery & Equipment Companies

See All

Machinery & Equipment Companies

See All -

Electronic Equipment Companies

See All

Electronic Equipment Companies

See All -

Transportation Equipment Companies

See All

Transportation Equipment Companies

See All -

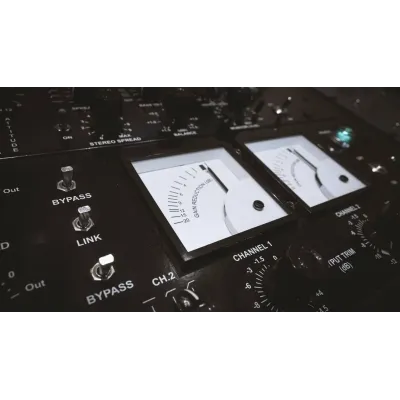

Instruments & Meters Companies

See All

Instruments & Meters Companies

See All -

Agricultural Products Brands

See All

Agricultural Products Brands

See All -

Life & Services

Life & Services

Top 10 Brands

More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned... -

-

Manufactures

-

Food & Beverage Manufacturers

See All

Food & Beverage Manufacturers

See All -

Textile & Apparel Industry Manufacturers

See All

Textile & Apparel Industry Manufacturers

See All -

Home Furniture Manufacturers

See All

Home Furniture Manufacturers

See All -

Building Materials Suppliers

See All

Building Materials Suppliers

See All -

Paper & Printing Factory

See All

Paper & Printing Factory

See All -

Energy & Chemical Suppliers

See All

Energy & Chemical Suppliers

See All -

Biopharmaceutical Manufacturers

See All

Biopharmaceutical Manufacturers

See All -

Mining & Minerals Manufacturers

See All

Mining & Minerals Manufacturers

See All -

Metal Smelting & Processing Factory

See All

Metal Smelting & Processing Factory

See All -

Metal Products Manufacturers

See All

Metal Products Manufacturers

See All -

Machinery & Equipment Manufacturers

See All

Machinery & Equipment Manufacturers

See All -

Electronic Equipment Manufacturers

See All

Electronic Equipment Manufacturers

See All -

Transportation Equipment Manufacturers

See All

Transportation Equipment Manufacturers

See All -

Instruments & Meters Manufacturers

See All

Instruments & Meters Manufacturers

See All -

Agricultural Products Suppliers

See All

Agricultural Products Suppliers

See All -

Life & Services

Life & Services

Our Brands

More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned...More Lists Are Being Updated Regularly. Stay Tuned... -

-

Countries

- Verified Enterprises

- Blog

- 0

- Home0

- Account0

- Blog0

- About 0

- Contact0

-

Companies...0

-

Food & Beverage Industry Companies

- Food Ingredients Companies0

- Edible Oils & Fats Products Brands1

- Meat, Poultry & Seafood Companies2

- Dairy & Egg Products Brands1

- Seasonings & Spices Brands2

- Nutritional Fortified Foods Brands0

- Instant Food Companies0

- Beverages & Mixes Companies1

- Bakery Ingredients & Ready-to-Eat Snacks Brands0

- Special Dietary Food Brands0

- Food Additives Companies0

- Snacks Foods Brands0

- Frozen Prepared Foods Companies0

- Certified Organic & Health Foods Companies0

- Specialty Foods Companies0

-

Textile & Apparel Industry Companies

- Men's Clothing Brands0

- Women's Clothing Brands0

- Footwear Brands0

- Luggage & Accessories Brands0

- Sports & Outdoor Gear Companies0

- Kids & Baby Clothing Brands0

- Fashion Accessories Brand0

- Home Textiles & Fabrics Brands0

- Protective Products & Technical Textiles Companies0

- Loungewear & Sleepwear Brands0

- Custom & Group Apparel Companies0

- Sustainable Fashion Brands0

-

Home Furniture Industry Companies

- Living Room Furniture Brands0

- Bedroom Furniture Brands0

- Dining Room Furniture Brands0

- Home Textiles & Soft Furnishings Companies0

- Home Lighting Companies0

- Kitchen Furniture Brands0

- Home Cleaning Appliances Brands0

- Bathroom Fixtures Brands0

- Smart Home Devices Company0

- Outdoor & Garden Furniture Company0

- Home Decor Brands0

- Building Materials Industry Companies

- Paper & Printing Industry Companies

- Energy & Chemical Industry Companies

- Biopharmaceutical Industry Companies

- Mining & Minerals Industry Companies

- Metal Smelting & Processing Industry Companies

- Metal Products Industry Companies

- Machinery & Equipment Industry Companies

- Electronic Equipment Industry Companies

- Transportation Equipment Industry Companies

- Instruments & Meters Industry Companies

- Agricultural Products Industry Companies

- Life & Services Industry

-

Food & Beverage Industry Companies

-

Manufactures...0

-

Food & Beverage Industry Manufactures

- Food Ingredients Suppliers0

- Edible Oils & Fats Products Suppliers1

- Meat, Poultry & Seafood Wholesaler2

- Dairy & Egg Products Suppliers1

- Seasonings & Spices Manufacturers2

- Nutritional Fortified Foods Manufacturers0

- Instant Food Manufacturers0

- Beverages & Mixes Manufacturers1

- Bakery Ingredients & Ready-to-Eat Snacks Suppliers0

- Special Dietary Food Suppliers0

- Food Additives Suppliers0

- Snacks Foods Manufacturers0

- Frozen Prepared Foods Manufacturers0

- Certified Organic & Health Foods Suppliers0

- Specialty Foods Supplier0

-

Textile & Apparel Industry Manufactures

- Men's Clothing Manufacturers0

- Women's Clothing Manufacturers0

- Footwear Factory0

- Luggage & Accessories Wholesaler0

- Sports & Outdoor Gear Manufacturers0

- Kids & Baby Clothing Manufacturers0

- Fashion Accessories Manufacturers0

- Home Textiles & Fabrics Suppliers0

- Protective Products & Technical Textiles Suppliers0

- Loungewear & Sleepwear Wholesalers0

- Custom & Group Apparel Manufacturers0

- Sustainable Fashion Manufacturers0

-

Home Furniture Industry Manufactures

- Living Room Furniture Factory0

- Bedroom Furniture Suppliers0

- Dining Room Furniture Factory0

- Home Textiles & Soft Furnishings Factory0

- Home Lighting Manufacturers0

- Kitchen Furniture Manufacturers0

- Home Cleaning Appliances Manufacturers0

- Bathroom Fixtures Manufacturers0

- Smart Home Devices Manufacturers0

- Outdoor & Garden Furniture Manufacturers0

- Home Decor Manufacturers0

- Building Materials Industry Manufactures

- Paper & Printing Industry Manufactures

- Energy & Chemical Industry Manufactures

- Biopharmaceutical Industry Manufactures

- Mining & Minerals Industry Manufactures

- Metal Smelting & Processing Industry Manufactures

- Metal Products Industry Manufactures

- Machinery & Equipment Industry Manufactures

- Electronic Equipment Industry Manufactures

- Transportation Equipment Industry Manufactures

- Instruments & Meters Industry Manufactures

- Agricultural Products Industry Suppliers

-

Food & Beverage Industry Manufactures

-450x250h.webp)

-150x150h.webp)